Owner’s Draws: What You Need to Know

Owners’ draws are crucial to accounting for businesses structured as partnerships, sole proprietorships, or limited liability companies (LLCs). As business owners invest their capital and labor into the company, they often take funds out for personal use, which are referred to as “draws” or “withdrawals.” This article comprehensively explains owners’ draws, their tax implications, and the proper accounting treatment for these transactions.

What are Owners’ Draws?

An owner’s draw is a withdrawal of money from a business by the owner for personal use. It is not considered a salary or wage; it is not subject to payroll taxes, and they do not impact the business’s net income. Instead, draws are recorded as a reduction in the owner’s equity account on the balance sheet.

Sole proprietorships, partnerships, and limited liability companies (LLCs) typically take owner’s draws. C corporations do not allow owner’s draws, as the profits of a C corporation are double taxed, once at the corporate level and then at the individual level when they are distributed to shareholders.

Differentiating Draws from Distributions

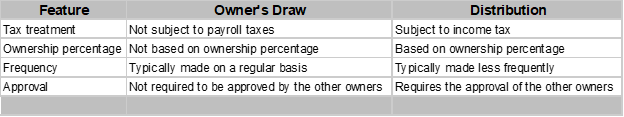

Owners’ draws should not be confused with distributions, which are payments made to owners in corporate structures like S corporations or C corporations and are considered dividends or profits. C corporations are subject to double taxation, meaning the corporation pays taxes on its profits at the corporate level, and then shareholders pay taxes on the distributed profits as individual income.

In contrast, S corporations are pass-through entities, where the profits are not taxed at the corporate level but rather “passed through” to the shareholders, who report the income on their personal tax returns. Draws are more commonly associated with partnerships, sole proprietorships, and LLCs.

Importance of Proper Documentation

Owners’ draws require accurate and well-documented records. Business owners must clearly track the amount and frequency of each draw to maintain transparency and ensure proper financial reporting. Keeping accurate records and documentation for these transactions is crucial for several reasons: financial clarity and transparency, compliance, audit readiness, separation of personal and business finances, and accurate tax reporting.

Impact on Taxation

The impact on taxation related to owner’s draws can vary depending on the type of business entity involved, particularly for partnerships and LLCs. The business and the owner are considered a single entity for tax purposes in a sole proprietorship. The draws are treated as part of the owner’s taxable income, and income tax is paid accordingly.

Partnerships are not taxed at the entity level. Instead, the partnership’s income or losses are passed through to the individual partners, who report their share of income, including draws, on their personal tax returns. Draws are not subject to payroll taxes but are considered part of the partner’s distributive share of the partnership’s income.

Limited Liability Companies (LLCs) are taxed based on their classification. Single-member LLCs are taxed similarly to sole proprietorships by default, where the owner reports business income and draws on their personal tax return. Multi-member LLCs, by default, are taxed as partnerships, and the taxation of draws follows the same principles as mentioned above.

Business owners need to understand the tax implications of owner’s draws based on their business structure. Seeking advice from tax professionals or accountants can help optimize tax strategies and ensure compliance with tax laws.

Withdrawal Limits

There are no legal withdrawal limits related to owner’s draws. However, in certain business structures, there might be limitations on the amount and frequency of owners’ draws. Such restrictions could be outlined in the partnership or operating agreements for LLCs. In addition, some businesses may set withdrawal limits to ensure that the company retains sufficient funds for operations, growth, and emergencies. These limits can vary depending on the business’s financial situation and its specific needs.

Handling Negative Draws

Negative draws occur when an owner withdraws more funds than their equity balance. This can create a negative balance in the owner’s equity or capital account. They are problematic for the business because they can decrease the available capital to cover expenses, invest in growth, or pay off debts. It can also create confusion and complications in financial statements and tax filings.

Dealing with negative draws requires careful consideration to avoid accounting discrepancies. It is crucial for owners to monitor the financial performance regularly, establish a proper system for owner’s withdrawals, and only take out what is appropriate and sustainable based on the business’s profitability and cash flow.

Impact on Financial Statements

Owners’ draws do not impact the income statement; they are not considered business expenses and, therefore, are not deducted from the company’s revenues to calculate net income. However, owners’ draws significantly impact the owner’s equity section of the balance sheet. Proper accounting ensures that the financial statements accurately reflect the owner’s equity position.

In conclusion, understanding the concept of owners’ draws is essential for any business owner operating as a partnership, sole proprietorship, or LLC. Proper accounting practice of draws ensures transparent financial reporting and helps owners make informed decisions regarding financial management and business growth. Seeking professional advice from accountants or financial experts can further enhance a business owner’s understanding of this critical aspect of accounting.